Be sure to review outstanding customer balances regularly and follow up on missed payments promptly. However, regular monitoring https://www.facebook.com/BooksTimeInc/ will allow you to identify potential issues early on before they become significant problems. One way to stay up-to-date with your cash inflows and outflows is by using accounting software that can import bank transactions automatically. Before recording transactions, it is essential to understand debits and credits. Debits are entries made on the left-hand side of an account while credits are entries made on the right-hand side. A debit entry increases assets and expenses while reducing liabilities and income, whereas a credit entry increases liabilities and income while reducing expenses and assets.

Tips for Effective Sole Trader Bookkeeping

However, these accounts need reconciliation just as much as bank accounts do. The credit card reconciliation process is similar but bookkeeping for sole trader requires some additional steps compared to reconciling bank accounts. Monitoring cash inflows and outflows ensures that all transactions are accurately recorded, while budgeting helps plan for future expenses.

- Integrity and trustworthiness are important qualities to cultivate as a bookkeeper.

- According to the US Bureau of Labor Statistics (BLS), the median salary for bookkeepers in the US is $45,860 per year as of 2021 1.

- However, it is still a good idea to keep digital records and use digital accounting software to make your bookkeeping easier and more efficient.

- This includes everything from expected revenue to anticipated expenses such as rent, wages, utilities, taxes, etc.

- You will just need to manually code items to the right categories directly in the accounting platform.

Preparing for Self-Assessment and Tax Returns

Despite our best efforts it is possible that some information may be out of date. Any reliance you place on information found on this site or linked to on other websites will be at your own risk. Furthermore, because the two Payments on Account are based on an estimated liability, there’s a third payment required, which is called a balancing payment. This needs to be made by the self-assessment tax return deadline (31 January following the end of the tax year).

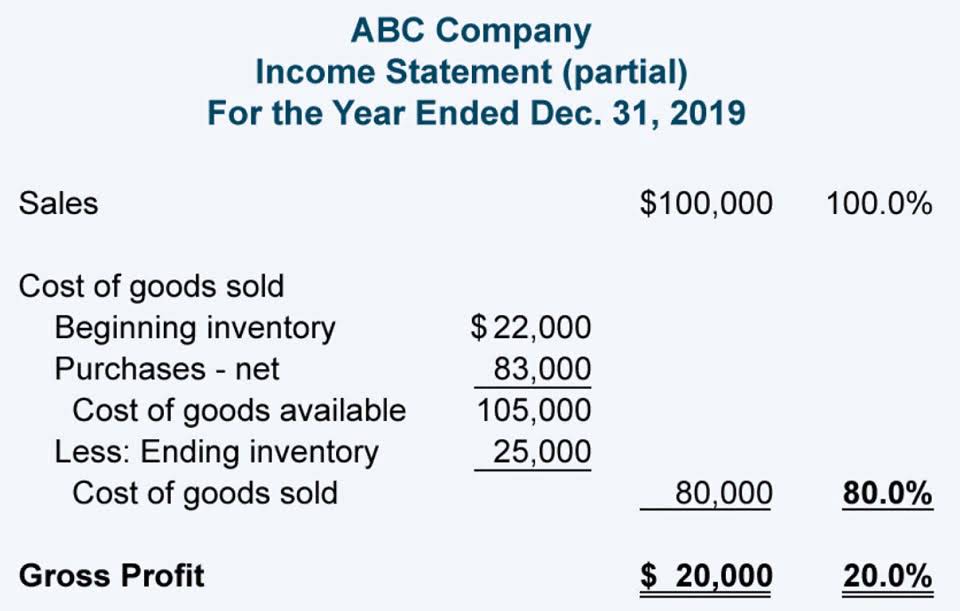

Inventory Updates

- By reviewing these reports monthly or quarterly, you can identify areas where you’re spending too much money or not generating enough revenue.

- There are plenty of other traits you need to know about limited companies and sole traders, but these are the basics.

- If an HMRC rep visits your business and finds you don’t have the proper records, you can be stuck with a hefty fine.

- As a sole trader, it’s essential to keep accurate records of your business transactions.

- As a sole trader, you need to register for VAT if your turnover is more than the current threshold, which is £85,000.

- Sole trader bookkeeping requires keeping your financial and business records up to date, as a daily process.

- Two of the most common are single-entry bookkeeping and double-entry bookkeeping.

We specialise in supporting independent businesses and work with 100,000 clients. Each TaxAssist Accountant runs their own business, and are passionate about supporting you. Or you can spot someone who hasn’t paid their invoice on time and gently suggest that you can’t do anymore work until you’re all square. Maintain discipline to log all documentation during bank feeds import or file upload. Also, provide a short summary at the top of each document describing its contents in detail. Once you’ve developed a budget, monitor your actual performance against it regularly.

- Sole traders may find it beneficial to seek professional help when it comes to managing their finances.

- The American Institute of Professional Bookkeepers offers certification for experienced bookkeepers.

- As with bank account reconciliations, regular reconciliation of credit card accounts is a vital aspect of effective sole trader record keeping and managing cash flow as a sole trader.

- Invoices should include the date, a unique invoice number, a description of the goods or services provided, and the total amount due.

- You typically maintain accurate accounting records across all transactions while communicating with others.

- It’s essential to be proactive about your tax obligations to avoid any penalties or interest charges for late payment.

You can then use the HMRC’s online calculator to work out how much you need to pay. If you pay them annually, you can do so as part of your self-assessment tax return. You need to get into the habit of chasing invoices early to make sure you have plenty of money to cover your https://www.bookstime.com/ business costs.